how to report coinbase on taxes

Even if you dont receive this form the IRS still holds you accountable for reporting your Coinbase activity. Mining and staking crypto or receiving airdrops.

Understanding Crypto Taxes Coinbase

In the search box search for investment sales and then select the Jump to link in the search results.

. Coinbase 1099-MISC Form 1099 forms are used to report any and all income that does not come from an employer. The crypto you receive directly from mining. 2 days agoCoinbase COIN 467 was trading at around 92 a share on Friday.

Regardless they give you the resources to get your tax information accurately. Crypto can be taxed in two ways. If you hold it for over 12 months its taxed at the lower long-term capital gain rates.

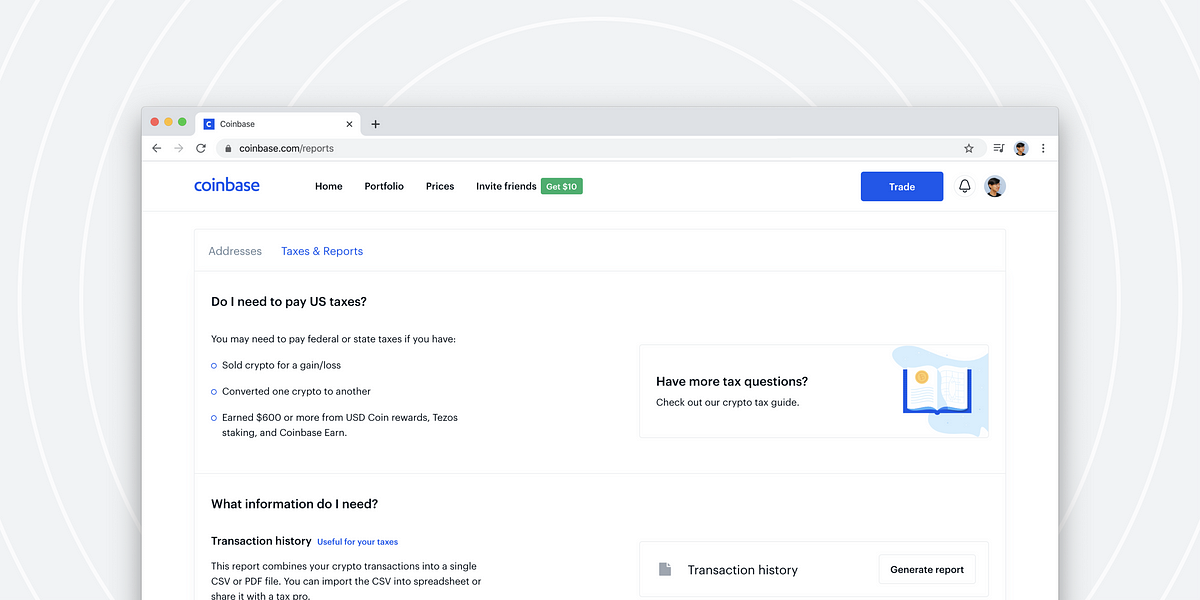

Go to the Reports page by clicking the user icon in the top header and click Reports. Follow these steps in the Premier Edition. Coinbase will also provide a copy of the form to its users aka you and as a taxpayer it is your duty to report all taxable activities while reporting taxes.

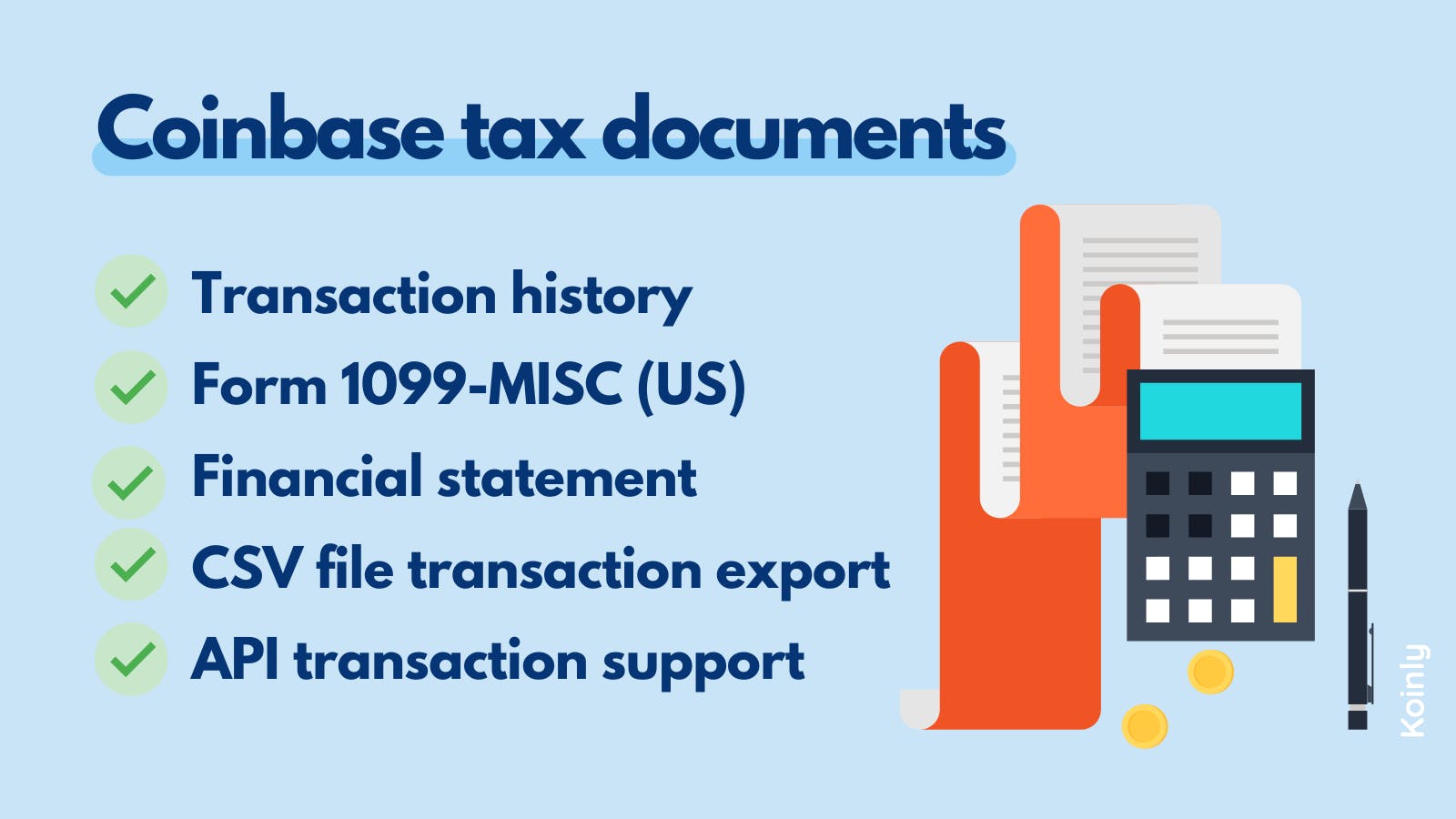

Resident for tax purposes and earned 600 or more through staking USDC rewards and Coinbase Earn rewards which are all considered miscellaneous income. Note that these tax forms do not report capital gains or losses. The Coinbase Transaction History CSV file contains a record of all of your buys sells transfers and investment activity that occurred within your Coinbase account.

Coinpanda has direct integration with Coinbase Pro to simplify tracking your trades and tax reporting. This report is designed to help taxpayers quickly and easily understand their gains or losses for the tax year using our. Import trades automatically and download all tax forms documents for Coinbase Pro easily.

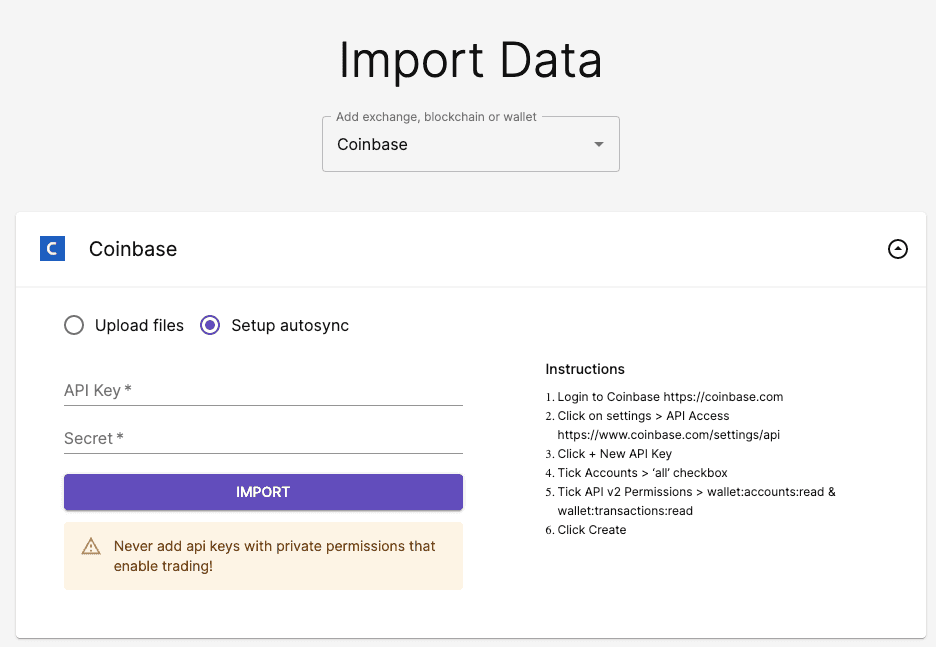

Click Generate Report for CSV report and click Download when the file is ready. You can also upload a CSVExcel file instead of connecting your account with the public address by following the steps explained below. Upload the file to.

Plus 10-15 on gains isnt that bad IMO. Click the Generate report button. If you are a big fish I would make sure to pay the taxes.

Currently the exchange sends Forms 1099-MISC to users who are US. Open continue your return in TurboTax. Traders and made more than 600 from crypto rewards or staking in the last tax year.

Leave the default settings All time All assets All transactions or specify the report you want. So when does Coinbase report to the IRS. Keep in mind that the IRS and Coinbase are currently in a disagreement about whether or not Coinbase needs to turn over all major data about its users.

One to the taxpayer and one to the IRS. The last option is to manually add transactions one by one from the Transactions page. How to Report Your Coinbase Pro Taxes.

If you have sold or converted crypto in the year 2020 and are subject to US taxes you are required to. Coinbase does offer reports to help you accurately report your taxes. This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost basis specification strategy.

If you get paid in bitcoin by your employee then there is a high chance that your crypto will be classified as compensation and you will have to pay tax on it in accordance with your income tax bracket. Coinbase tax documents. Simply follow the steps below to get your public address and your tax forms will be ready shortly.

Getting paid in crypto by your employer. Calculate and prepare your Coinbase Pro taxes in under 20 minutes. The exchange sends two copies of each crypto tax document.

Yes youll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not Coinbase does report your crypto activity to the IRS if you meet certain criteria you should be a Coinbase customer. In the last five days the companys stock has risen by more than 50. If you meet certain requirements discussed below you can get the form directly through Coinbase.

You can count on the IRS going back through your history. When required by the IRS the crypto exchange or broker you use including Coinbase has to report certain types of activity directly to the IRS using specific forms and provide you with a. Coinbase tax reporting takes place well ahead of the annual tax season and crypto taxes occur at the same time as income taxes.

A US person for tax purposes. Youll receive the 1099-MISC form from Coinbase if you are a US. However the crypto universe is expanding fast theres just.

Coinbase tax reporting occurs ahead of the annual tax season and taxes on cryptocurrency transactions are due at the same time as income taxes. Should have earned 600 or more in rewards or fees from Coinbase Earn USDC Rewards andor Staking. Calculate your taxes and generate all.

While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS. The most common reason people need to report crypto on their taxes is that theyve sold some assets at a gain or loss similar to buying and selling stocks so if you buy one bitcoin for 10000 and sell it for 50000 you face 40000 of taxable capital gains. You can request a 1099 form to complete your taxes.

Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets.

Coinbase Is Committed To Helping Our Customers During Tax Season By Coinbase The Coinbase Blog

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Coinbase Debit Card Tax Guide Gordon Law Group

Does Coinbase Report To The Irs Zenledger

How The Irs Knows You Owe Crypto Taxes

Coinbase Pro Tax Documents In 1 Minute 2022 Youtube

The Complete Coinbase Tax Reporting Guide Koinly

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Top Crypto Exchange Coinbase Rolls Out Full Retail Support For Three Low Cap Altcoins The Daily Hodl

Coinbase Downloading Tax Reports Beta Youtube

Did You Trade Crypto In 2018 If So You May Owe Taxes If You Re A Us Taxpayer Here Are Steps You May Have To Take What Forms You Ll Tax Guide

Ontology Weekly Report June 18 Ontologynetwork Technical Documentation Founding Fathers Future Plans

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

10 Euros Offert En Bitcoin Sur Coinbase